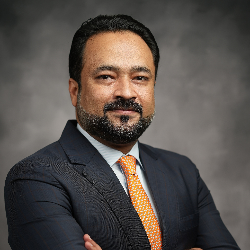

Muhammad Farrukh

Speaker

Director Treasury and Corporate Finance

K-Electric

Upgrade to initiate conversation first

Upgrade

Plenary

The Borrowers Panel - Navigating the Expanding Landscape:

Muhammad Farrukh

Director Treasury and Corporate Finance,

K-Electric

Omar Qasim

Global Capital Financing Division,

Public Investment Fund of Saudi Arabia

Mohammed Alyousef

Head of Corporate Finance,

Saudi Electricity Company (SEC)

Manav Futnani

Global Head of Export Finance, HSBC Infrastructure Finance | HSBC,

HSBC

Plenary

A Look to the Horizon – Exploring Opportunities in the Frontier Markets

Muhammad Farrukh

Director Treasury and Corporate Finance,

K-Electric

Layali Abdeen

Head of Middle East and Egypt,

MIGA - Multilateral Investment Guarantee Agency

Christopher Cantelmi

Principal, Natural Resources & Infrastructure,

IFC World Bank Group

Bruce Johnson

Director,

Masdar

Zishan Iqbal

Expert,

Independent